Top Stories and podcasts

Top Stories and podcasts

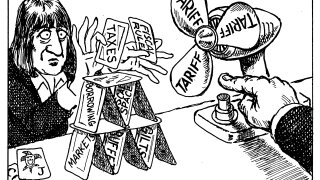

EFSF scores top-end size as market braces for Trump tariffs

◆ Deal went ahead despite tariffs-related volatility ◆ Assessing fair value was key ◆ Supra now nearly 56%-funded

Clear success of Tuesday's euro corporate bond issues should give others confidence

Fresenius garners €7bn demand as IG corporates ignore tariff threats

◆ Fresenius, Danone and Proximus benchmarks shake off tariff turmoil ◆ Range of new issue concessions needed ◆ High orderbook attrition for those pushing hard on spread

Mizuho hires new head of EMEA CIB from BNP Paribas

Banker with wide experience will join in October

Clear success of Tuesday's euro corporate bond issues should give others confidence

-

◆ Farewell, KommuneKredit ◆ Covered bonds advance on SSAs’ territory ◆ Ivory Coast makes funding breakthrough ◆ Romania’s risks

-

This week's chatter is on the hopes and fears for deal activity in European ABS, with a short trip to the Middle East.

P&M, Big Interview, Leader, View, Southpaw

-

Innovation has generated 500 deals without requiring extra bankers

-

Americas CEO Stefan Simon to leave for personal reasons

Mortgage credit specialist continues to carve out niche in small bulk loans, and has just closed largest fundraise

Withdrawal consequences would depend on how much other shareholders stepped up

Chancellor's best efforts may be in vain

No reason for banks to fear going tighter still

Clear success of Tuesday's euro corporate bond issues should give others confidence

The pay-off of keeping work at bay when it comes to family is bigger than the downside

HSBC’s investment bank could have a new strategy this month after negotiating a stay of execution from the CEO for parts of M&A and ECM. But the truncated bank will have a harder time convincing clients

Upheaval in US-Europe relationship could reshape the M&A landscape

Primary Market Monitor/Bond Comments

Sponsored Content

-

-

Sponsored by Debtdomain - S&P Market Intelligence

Syndicated Loan, Leveraged Finance and Private Debt Awards 2024: Technology Provider of the Year — S&P Global Market Intelligence, Debtdomain